Content

Therefore, in most straightforward instances, fixed costsare not relevant for productiondecision, and incremental costs, or variable costs, are relevant for these decisions. Variable and fixed costs are completely contradictory to each other but serve a major role in financial analysis. While variable costs tend to remain flat, the impact of fixed costs on a company’s bottom line can change based on the number of products it produces. So, when production increases, the fixed costs drop.

Variable costs are any expenses that change based on how much a company produces and sells. This means that variable costs increase as production rises and decrease as production falls. Some of the most common types of variable costs include labor, The Difference Between Fixed Cost and Variable Cost utility expenses, commissions, and raw materials. Other examples of fixed costs include executives’ salaries, interest expenses, depreciation, and insurance expenses. Examples of variable costs include direct labor and direct materials costs.

Mixed Costs

In other words, your sales volume directly impacts your variable expenses. In fact, distinction between prime cost and supplementary https://online-accounting.net/ cost is not meaningful but distinction between fixed costs and variable costs is crucial in the short-run.

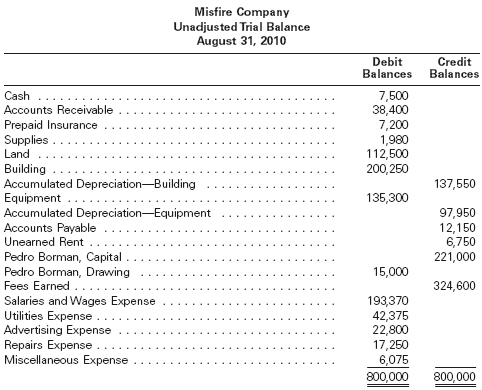

Fixed CostsVariable CostsMeaningIn accounting, fixed costs are expenses that remain constant for a period of time irrespective of the level of outputs. The term cost refers to any expense that a business incurs during the manufacturing or production process for its goods and services. Put simply, it is the value of money companies spend on purchasing and selling items. Businesses incur two main types of costs when they produce their goods—variable and fixed costs. Once you know your fixed and variable costs, you can find your business’s total expenses. To find your total costs, simply add your fixed and variable expenses. Business expenses are categorized as either fixed or variable costs.

What is Variable Cost?

A firm’s total cost is the sum of its production and non-production costs. Total costs are calculated by summating fixed costs like rent and salaries to variable costs like raw materials and hourly laborers. Businesses can use fixed and variable costs to calculate the various concepts to help them maximize their outcomes. Using these formulas can allow companies to determine how changes to their output level can reduce average fixed costs or find the optimal level of variable cost. Both fixed costs and variable costs contribute to providing a clear picture of the overall cost structure of the business. To demonstrate, let’s use the same example from above. In this case, suppose Company ABC has a fixed cost of $10,000 per month to rent the machine it uses to produce mugs.

- Budget for essential expenses first, such as housing, car payments and child care.

- The most common examples of fixed costs include lease and rent payments, property tax, certain salaries, insurance, depreciation, and interest payments.

- The two kinds of business costs are fixed costs and variable costs.

- Based on variability, the costs has been classified into three categories, they are fixed, variable and semi variable.

- However, at some point fixed costs increase to accommodate the need for more capacity.